Shower Door Factory

SALLY Group

We look forward to assisting you with your upcoming business.We warmly welcome you to become our distributors and sell our bathroom products in your country.

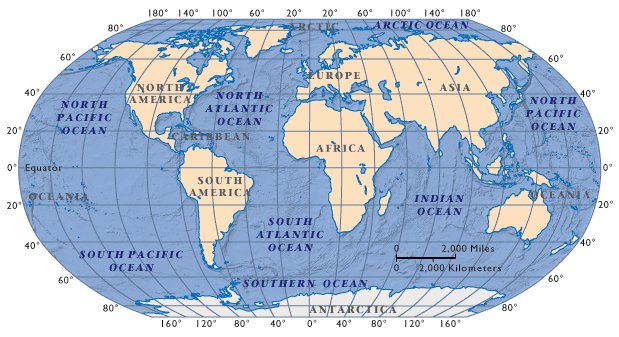

Which countries have potential for exporting China's high-end sanitary ware brands?

When expanding into international markets, China's high-end sanitary ware brands should conduct comprehensive assessments based on the target market's economic conditions, consumer demands, policy environments, and cultural preferences. Below are analyses and suggestions for potential countries and regions:

I. High-Potential Developed Markets

North America (United States, Canada)

Advantages: Strong consumption capacity, high demand for high-end residential and commercial projects; smart and eco-friendly products are popular.

Challenges: Fierce competition from local brands (such as Kohler, Moen), requiring differentiated positioning (e.g., design innovation, cost-effectiveness).

Strategies: Target high-end hotels and real estate developers for collaboration; reach consumers through e-commerce channels (such as Wayfair).

Western European Countries (Germany, France, United Kingdom)

Advantages: High requirements for quality and design, green-certified products (e.g., water-saving, low-carbon) have an advantage.

Challenges: Dominance of local brands (such as Grohe, Hansgrohe), requiring strengthened technical certifications and brand storytelling.

Strategies: Increase exposure by participating in the ISH trade fair in Cologne; launch co-branded products with European design studios.

Australia and New Zealand

Advantages: Stable real estate market, preference for smart homes and eco-friendly products; strategically located in the Asia-Pacific for logistics.

Strategies: Collaborate with local building materials chains (such as Bunnings); promote corrosion-resistant, water-saving products.

II. Emerging High-Growth Markets

Southeast Asia (Singapore, Malaysia, Thailand)

Advantages: Rising middle class, luxury apartments and tourism driving demand; policy support (RCEP reduces tariffs).

Key Cities: High-end real estate projects in Singapore, Kuala Lumpur, and Bangkok.

Strategies: Localize designs (suited to hot and humid climates); establish channels through exhibitions (ASEAN Bathroom Fair).

Middle East (United Arab Emirates, Saudi Arabia, Qatar)

Advantages: Developed luxury real estate and tourism sectors, preference for high-end designs like gold plating and marble; low costs in free zones (such as Dubai).

Strategies: Participate in Dubai BIG5 exhibition; collaborate with local developers (such as Emaar) to provide customized solutions.

Eastern Europe (Poland, Hungary, Czech Republic)

Advantages: Rapid economic growth, heated real estate investments, high acceptance of cost-effective high-end brands.

Strategies: Establish presence in building materials wholesale markets; utilize China-Europe freight trains to reduce logistics costs.

III. Long-Term Potential Markets

Latin America (Mexico, Chile, Brazil)

Opportunities: Accelerating urbanization, growing middle-to-high-income groups; limited local production capacity, reliant on imports.

Risks: Economic volatility, requiring selection of politically stable countries (such as Chile).

Africa (South Africa, Nigeria)

Opportunities: Infrastructure and real estate in their nascent stages, significant long-term potential.

Strategies: Initially test demand through trade, later consider local assembly.

IV. Key Success Factors

Localization Adaptation:

Designs that align with local aesthetics (such as the luxurious style in the Middle East, minimalist style in Northern Europe).

Compliance with certification standards (such as UPC in the US, CE in Europe, ESMA in the Middle East).

Channel Development:

Establish partnerships with local distributors, building materials suppliers, and real estate developers.

Leverage cross-border e-commerce (Amazon, local platforms) to cover the retail end.

Brand Marketing:

Shape a high-end image through international exhibitions and social media (Instagram, Pinterest).

Tell the story of "Made in China with Intelligence," emphasizing technological innovation and craftsmanship quality.

After-Sales Service:

Establish local warehousing and after-sales teams for prompt responses.

V. Recommended Priority

Short-term (1-3 years): Middle East (UAE), Southeast Asia (Singapore), Australia.

Medium-term (3-5 years): United States, Western Europe (Germany), Eastern Europe (Poland).

Long-term (over 5 years): Latin America (Mexico), Africa (South Africa).

In summary,

markets with greater potential may include specific segments in developed countries in Europe and North America (such as high-end niche markets in the US, Canada, and Germany), affluent countries in the Middle East (UAE, Saudi Arabia), emerging economies in Southeast Asia (Singapore, Malaysia), and Australia. Additionally, countries in Eastern Europe and parts of Latin America may also present opportunities but require more in-depth market research. With precise positioning and flexible strategies, China's high-end sanitary ware brands have the potential to break through in global markets and gradually establish international influence.